A message from our team

The road to supporting the green transition

From the beginning, our unwavering strategy has been to invest in companies that build resilience within their organizations and the world, contributing to a healthy planet. While our conviction remains, the landscape has evolved significantly over our 13-year journey. Notably, the eagerness of investors to support sustainability-focused funds has reached new heights, marking 2023 as a remarkable year.

Our fundraising efforts for Alder III exceeded expectations and by the end of the year we were on course to meet our target of SEK 3 billion. This was double the total of Alder II - a considerable feat given the uncertain economic times we are currently living through. The success of Alder III shows a growing recognition of the immense potential and untapped opportunities in financing the green transition as well as our long track record in sustainable investments.

We wasted no time securing Fund III's first two platform investments. Insort, focuses on hyperspectral imaging - a technology pivotal for optimising sorting applications and minimising food waste. EWGroup, brings qualified services and capacity for managing hazardous waste, aligning with our commitment to resource efficiency and creating a circular economy.

2023 also saw two successful exits of Alder I portfolio companies Aidon and Satel. It has been rewarding to be a part of their journeys. These exits showcase Alder's success and create a compelling story for potential investors and portfolio companies by demonstrating our ability to build companies with a positive impact and strong financial returns.

The work to develop our portfolio companies has continued focusing on developing tools to better measure and substantiate their sustainability impact. We have seen significant growth in our portfolio, both financially and in terms of sustainability performance.

Internally, Alder has undergone several noteworthy developments, including recruiting two key positions - Chief Financial Officer and Investment Director. We also finalized and rolled out an updated version of our internal sustainability guidebook, The Alder Way to incorporate the latest regulatory requirements and introduce our Impact Toolbox. Together with the new fund and portfolio companies, these initiatives set the stage for positive momentum in the upcoming year.

Of course, the year has not been without challenges. Our job will always be about resilience; adapting to, managing and overcoming hurdles. Whether it is portfolio companies facing a downturn, instability in the world economy, or the knock-on effects of global conflicts.

The hard work of our portfolio companies, our committed and tight-knit team, an active-ownership approach and robust governance principles mean that we can overcome challenges and come out stronger. In this spirit, we look forward to the year ahead and the opportunities that await us, our portfolio and our investors.

The Alder team

A snapshot of Alder in 2023

3

Funds

11

Companies

1

Exits

2

New investments

6

Add-on acquisitions

1500+

Employees across all portfolio companies

13

Alder employees

>50%

CO2 emissions intensity reduced compared to 2022

+4 bn SEK

In revenue

100%

Active ownership

Article 9

For all funds

Two dimensions of sustainability

We approach sustainability from two distinct but interconnected angles: handprint covers the positive impacts of what our portfolio companies do, and footprint is concerned with decreasing the negative impacts of our companies' operations.

To ensure that we remain on course to achieve our mission to contribute to a sustainable future, we have a rigorous process for investment selection and the governance of our portfolio companies. We follow recognised external sustainability frameworks and internal procedures for an effective entry, ownership and exit process.

Investment themes - future-ready investments

We have a proactive strategy and processes for identifying promising companies for investment opportunities, where we have an opportunity to build companies that enable a resilient future within the planetary boundaries. To better serve these areas, we have defined four key investment themes:

Natural resources

We require a shift towards solutions that provide sustainable ecosystem services and that contribute to reversing biodiversity loss. Examples include limiting air emissions, providing clean water, efficient food systems, smart consumption and long-term carbon capture and storage.

Safe Monitoring Group, 3nine, Centriair, Insort

Building efficiency

With a growing population, there is an increasing need for smart and efficient buildings. Improving energy use and carbon emission standards throughout the lifecycle of new and existing buildings is vital. A focus on building optimisation, resource efficiency and preservation is required.

Umia, SI, Briab

Intelligent infrastructure

As urban populations grow, we require smart infrastructures that form the foundation of sustainable societies. Investments in renewable energy, energy storage and smart transportation systems are needed to accelerate technological development.

AB Inventech, EcoMobility

Sustainable industry

Industry emissions have increased exponentially over several decades, and we have gone from a small species on a big planet to a large species on a small planet. Time is of the essence, implying rapid transformation towards circular processes, smart materials and optimized manufacturing.

Scanacon, EWGroup

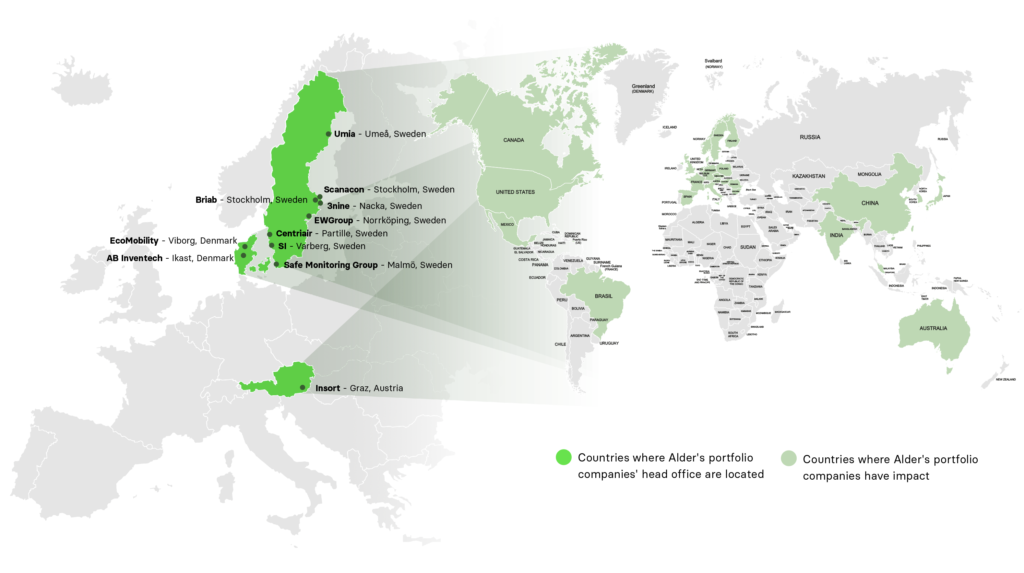

Our geographical focus continues to be on the Nordic region, but platform investments can be made in the broader European market and in 2023, Alder invested in Insort, based in Austria.

2023 investments

Two waste problems, two innovative solutions

Autumn was a busy season at Alder as we closed two new platform investments - Insort and EWGroup (EWG).

Our first investment in Alder III was of EWGroup, a one-stop shop for treatment of contaminated materials primarily generated by the construction industry. Demand for recycling services for construction waste and its residual products exceeds supply, so EWG is well positioned for growth. We recognised their significant potential to minimise the use of finite resources and decrease human and environmental exposure to toxic materials.

Read more about EWG here.

Our second investment in Alder III was of Insort, a pioneer in Hyperspectral Imaging (HSI) for the food processing industry. Insort, based in Austria, is the culmination of efforts from our team to find a company at the forefront of this promising technology. Insort's solutions make an important contribution to reducing food waste and help improve food quality and safety.

Read more about Insort here.

Portfolio company targets for 2024

Define how we will work with

positive environmental impact

Linking impact and value

Strengthened strategies

Embrace The Alder Way

Transparency & participation

Clear targets & roadmaps

Commitment

We walk the talk